Not only will the tax reduction remain until the end of the year, but also certain sub-accounts of the Szép card can be transferred until December 31, the parliamentary secretary of the Ministry of Finance pointed out. András Tállai emphasized that the favorable rules of the Szép card could leave more than HUF 50 billion for the affected parties this year.

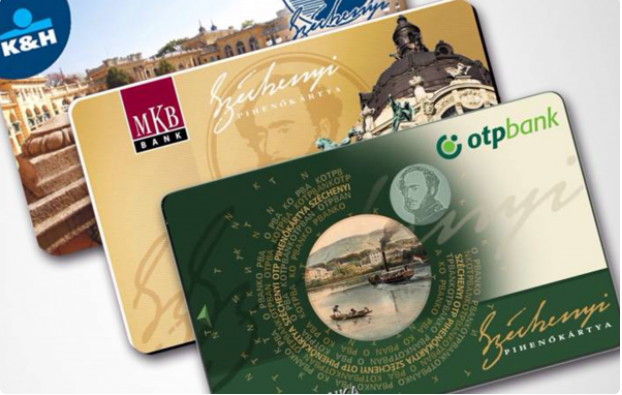

Interoperability means ease for about one million employees, the essence of which is that the fringe benefit transferred to certain sub-accounts of the Széchenyi Pihenő Kártya can also be used to offset services specified in any other sub-account.

Tax exemptions also help the tourism sector, which has been hit the hardest by the coronavirus crisis. No tourism development contribution has to be paid until December 31, 2021, which affects 15,000 businesses. The measure is not only about reducing taxes, but also about reducing administration, since you don't even have to submit a return for this period.

He recalled that starting from April 22, 2020, the government halved the tax burden of the Szép-kártya, which was 32.5 percent on April 21 last year, but has since dropped to only 15 percent. According to one of the government's latest decisions - valid since June 9 - the favorable tax burden will remain until the end of 2021, i.e. only 15 percent personal income tax must be paid for the employer support given to the Szép card.

more about this here .