Inflation is the biggest enemy of the central banks, overcoming it is the most important step towards sustainability in the field of money - wrote György Matolcsy, the president of the Magyar Nemzeti Bank (MNB) in his article published on magyarnemzet.hu.

Matolcsy noted: the sooner a central bank can win the fight against inflation, the better it can use the means of money creation.

80 percent of Hungary's inflation is imported, so the world's central banks can only win together, says György Matolcsy. He said that the fight against inflation is "the key to entering the new era".

"Ours is an era of great technological breakthroughs, which bring innovations to all areas of modern life, including finance. The central banks will not be left out of this either, and will even act as an engine to speed up the transition to the future of money and the money of the future. One of the defining characteristics of the 2020s will be the innovation of central bank operations," he wrote.

György Matolcsy recalled that the Hungarian central bank was the first in Europe to receive a sustainability and green mandate,

but this, he believes, will become commonplace in the current decade. The central bank's general QE (quantitative easing) programs are being replaced by targeted credit instruments.

The head of the MNB mentioned that the world's central banks are still experimenting with central bank digital money, but during the decade all central banks will use some form of digital central bank money.

The renaissance of cryptocurrencies is expected to continue, but in this field "the world is still boiling" , there will be new winners and previous successful ones may also fail, he noted.

Finally, the governor of the central bank also wrote that the introduction of digital central bank money sharpens the debate about the future of the financial system. "The Hungarian central bank believes in a federal relationship between the parliament, the government, the central bank and the actors of the financial sector" .

According to György Matolcsy, today's two-tiered banking system should not be moved towards a single-tiered financial system, but rather the opposite, towards a more diverse but more concentrated and therefore stronger financial system compared to today. This could bring a 3.0 financial system based on fusion and platforms to Hungary by the end of the decade, stated the Central Bank Governor.

Source: Mandiner.hu

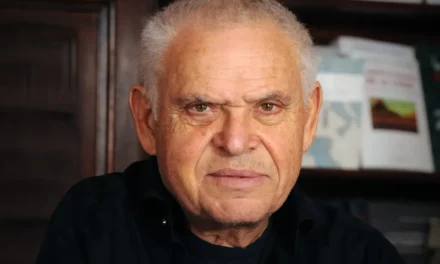

Image: MTI/Zsolt Szigetváry