In the national consultation, everyone can now express their opinion on whether the extra-profit taxes should remain, or whether we should give in to pressure from Brussels and leave more money in the pockets of the multis?

"The third question of the national consultation asks about maintaining the windfall tax. Brussels would introduce it at the end of the year, so the multi-companies profiting from the epidemic and the war would no longer have to make a substantial contribution to common expenses from their profits.

This Brussels policy would place more burdens on the shoulders of Hungarians, even though the multis would be curbed in several EU member states.

The eternal truth of Winston Churchill, according to which »Don't waste the opportunity that a good little crisis gives you!«, is also known by multinational companies.

Not only do they know, but they also use it under the pretext of COVID and war: they raise prices; they do not pass on the higher interest rates to depositors, or the central bank interest rate cut is not followed by a noticeable reduction in their loan rates. In other sectors, for the same amount of money, we get a smaller quantity or fewer services. Multis like to remove themselves from social solidarity, they typically only look at their profits. Seeing this, the Hungarian government imposed an extra profit tax in particularly profitable sectors, the income of which goes to the utility and national defense funds.

Brussels is attacking this now, when it expects to eliminate extra profit taxes at the end of the year.

The introduction of the extra profit tax is a political decision, the aim of which is to moderate the desire for profit of the multinationals, reallocate resources, or reduce the budget deficit. We have seen how many member countries (Czech Republic, Lithuania, Hungary, Italy and Spain) considered and decided to tax the extra profits of large pharmaceutical and energy companies or banks. We saw something similar during the financial crisis of 2008, when the payment of managerial bonuses and shareholder dividends of banks saved with taxpayers' money was restricted.

Taxation of extra profit was also proposed in the fall of 2022 in Brussels, which was defined as profit exceeding the average of the previous four years by more than twenty percent, but the lobbyists watered down the draft so much that it could not achieve its original goal.

The "price caps" remained, which - as shown by the example of the sixty dollars per barrel imposed by the G7 on Russian oil - rather do not work.

Instead of the "price caps" preferred by Brussels and the EU recommendations watered down by lobbyists, the Hungarian extra profit tax is a transparent and easily verifiable temporary measure, the income of which is "tied": the world market price of energy can rise again at any time, so it is necessary to pay Hungarian households 181,000 per month to continuously ensure the coverage of overhead support with HUF. This is what the overhead protection fund serves. And the national defense fund serves to achieve national defense expenditures of two percent of GDP as expected by NATO, that is, the development of the national defense and the defense of Hungary in times of danger.

In the national consultation, everyone can now express their opinion on whether the extra-profit taxes should remain, or whether we should give in to pressure from Brussels and leave more money in the pockets of the multis?"

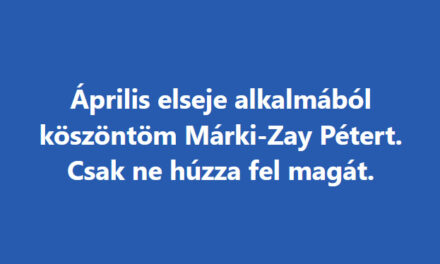

Featured Image: Facebook