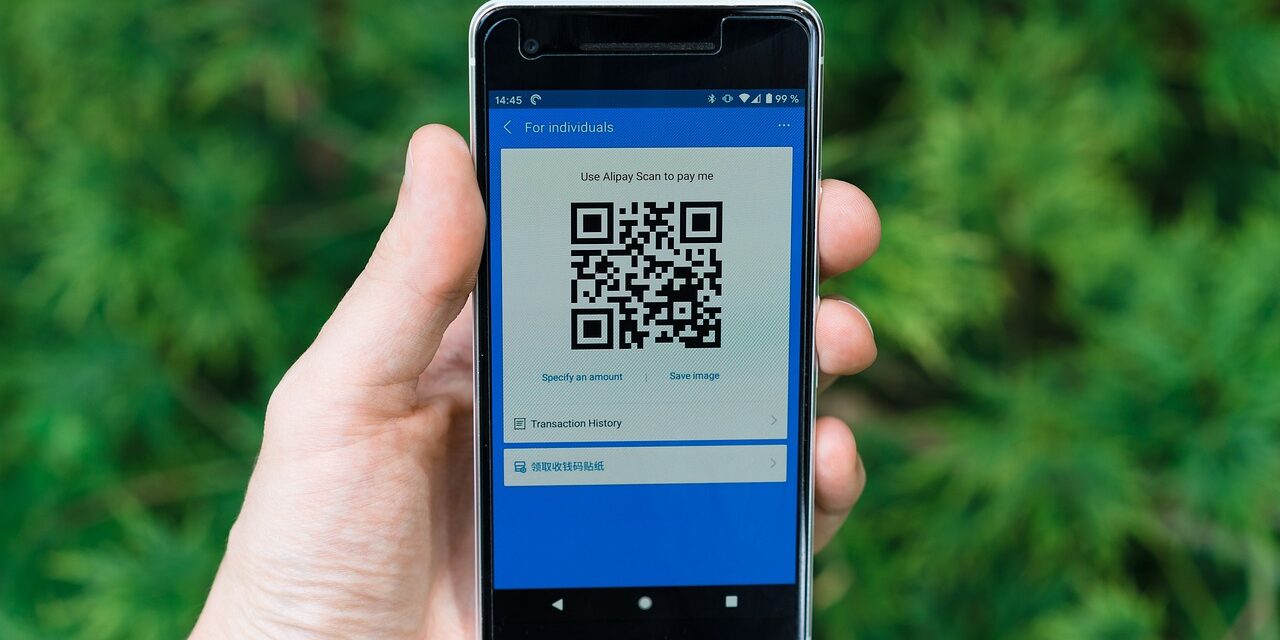

From Sunday, qvik is coming, a payment system that is used to pay by scanning a QR code via mobile phone. According to the vice president of the Magyar Nemzeti Bank, QR code payment will be a convenience function.

From September 1, a new payment option will be available for Hungarian people. Payment by QR code will soon be available - reports Portfolio, based on the previous announcement of Barnabás Virág, vice-president of the MNB .

International experience shows that the most important factor when naming payment methods is conciseness. Nowadays, the Swedes swish, the Swiss twintel, the Poles blink, the Slovenians flick or the Brazilians PIX. Out of more than 50 different name proposals in our country, qvik was finally chosen. The new payment solution marked with the qvik brand name will be available to all bank customers.

Based on the expectations, there will be more shops, retailers, and even department store chains where this solution will be applied, even in the coming days or weeks. As in the case of card payments, the stores will inform customers that they can also initiate payment by scanning the QR code.

In the case of qvik, banks cannot charge any fees for payments, and they are also exempt from transaction fees, which is an advantage over card payments. However, it is important to point out that a bank account is a prerequisite for qvikes payment.

Shops receive the counter value for qvik-based payments immediately, whereas, for example, the counter value for card payments typically takes 1-2 days, but for weekend purchases, they can receive it up to 4 days later.

QR code payment appears as a convenience function in people's lives, however, what novelty and simplicity it can bring is a more interesting question.

The MNB, in cooperation with Giro and the banks, has set the goal of creating a domestic electronic payment solution based on the Instant Payment System, which also handles domestic instant transfers, which can be an alternative or competitor to card payments. qvik will be domestic, safe and competitive in terms of pricing

- said Barnabás Virág, vice president of the Hungarian National Bank (MNB).

Featured Image: Pixabay