More than once, the tax rules created by the socialist-free democratic cabinet for 2010 have resulted in brutal deductions. Since then, the public burden of work has been significantly reduced.

Do the tax changes of the last ten years favor the majority or the minority?

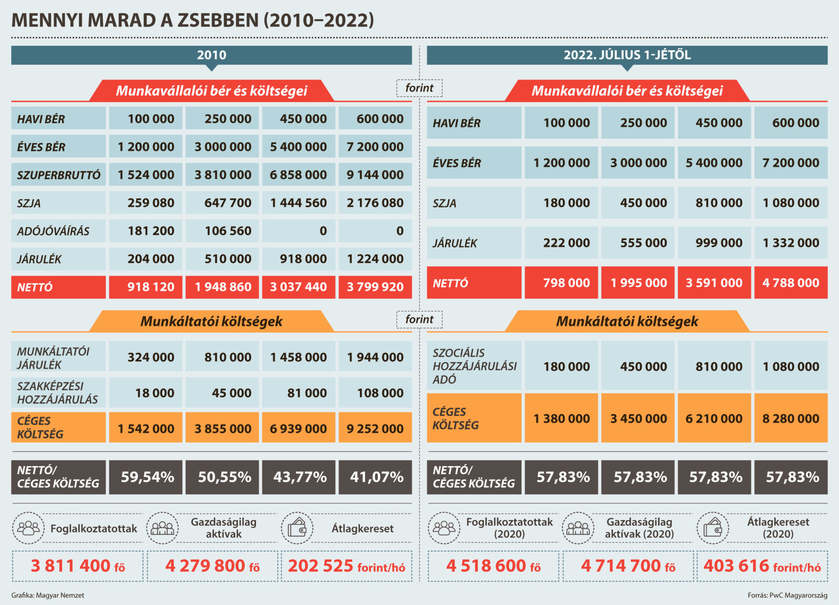

This question regularly arises in the course of political changes, and the calculation prepared by PwC Hungary based on the suggestions of the Hungarian Nation certainly gives a clear answer to this question, generally speaking. The data sets compare the conditions in 2010 with 2022. The latter - in its currently planned form - are outlined in the proposal on next year's budget law and the new tax changes - both proposals are already on the parliament's table. In personal income taxation, a decade ago, the institution of tax credit still existed, so the tax on the lowest wages was very low - the difference is still visible at a monthly gross of HUF 100,000 (i.e. HUF 1.2 million). However, the favorable effect of the rule supporting those who earn less quickly dissipated. In 2010, the so-called super-grossing was still alive, and of course the tax rate was also higher, so

Today's rule system already leaves more than HUF 250,000 gross per month (i.e. HUF three million per year) in the workers' pockets, roughly fifty thousand HUF per year.

In our country, the monthly gross earnings nowadays already exceed four hundred thousand forints, so it is worth investigating this value as well. HUF 450,000 per month means HUF 5.4 million in a year. Of this, the 2010 rules left the employee with only three million forints, today almost 3.6 million. The difference is half a million forints per year. The difference is even greater one step up, at HUF six hundred thousand per month

Out of the 7.2 million forints appearing as gross, the 2010 sja system left 3.8 million, almost half of the salary was taken away by the state. Today's tax rules leave almost a million more in the pockets of employees.

Following the MN's questions, another calculation was made at PwC. This also takes into account the burdens of employers, because when calculating wages, not only the public burden of the employee (the tax and the contribution) is taken into account, but also how much tax the employer himself has to pay on top of that

. Previously, in addition to the employer's contribution, a vocational training contribution was discussed, but the latter burden will certainly cease in a year, so from July 2022 only the social contribution tax (which replaces the contribution) will be charged to businesses. But let's see the numbers! In 2010, one hundred thousand forints per month, or 1.2 million annual gross, cost an employer at the time more than one and a half million forints. Out of one and a half million forints, the employee received 918 thousand, the rest went to the state. It wasn't even that high. The worker received HUF 1.948 million from the annual gross of three million HUF, while his employer had to account for a total of HUF 3.855 million, so half of the amount was taken by taxes. As the wage increased, the ratio got worse and worse: the employee received 3.8 million out of 7.2 million gross annual wages (which means a monthly gross salary of six hundred thousand forints), but this cost the company almost 9.3 million forints. Here, the state took approximately HUF 5.5 million.

Sixty percent of the wage cost was therefore paid by the tax.

It is worth comparing the rules that will be in effect from the middle of next year and their consequences. One hundred thousand forints gross, that is 1.2 million gross - as it has been for a long time, so it will be next year - will mean roughly eight hundred thousand net, but the employer will be charged only 180 thousand forints plus tax. With a gross monthly salary of a quarter of a million, i.e. an annual gross salary of three million, approximately two million remain in the employee's pocket, for which the company pays approximately three and a half million forints - hundreds of thousands of forints less than it paid in 2010.

But let's look at the current average wage : at 450,000 per month, i.e. 5.4 million annual gross, 3.6 million will be paid to the employee next year, the employer's total wage cost is 6.2 million forints. Approximately sixty percent of the money will remain with the employee, exactly as in the higher income categories. Six hundred thousand monthly, or 7.2 million annual gross wages, for example, will cost the company 8.3 million. The employee can pocket 4.8 million of this, and the state will get 3.5 million. How was this according to the 2010 rules? A colleague earning six hundred thousand per month cost the employer 9.3 million per year, the employee received one million less, 3.8 million, and the state took almost 5.5 million forints.

Next year, the budget will settle for two million less.

It is clear from all of this that, according to the 2010 rules, it was very expensive to create jobs and hire quality labor. Because of this, many people either worked more in black or not at all. Another interesting comparison is included in PwC's compilation:

In 2010, the tax office registered 3.8 million employed persons, 4.5 million last year. In 2010, the average salary was HUF 202,000, and last year it was HUF 403,000.

Source: magyarnemzet.hu