At the beginning of March, Credit Suisse published the article of its expert, Zoltán Pozsár, who tried to find an explanation in the global conflict between the great powers and the unfolding crisis of raw materials.

Zoltán Pozsár considers the current environment to be more complex than the period of previous crises. Now, in contrast to the crises of 1997, 2008 or 2020, the problem is not only nominal (currency market constraints, parity or overdrafts), but also real: goods have become real resources. Because the lack of food, energy, metals and resources cannot be treated with quantitative easing.

You can print money, but not heating oil or food wheat.

Pozsár draws the conclusion that the thickening borders, which can even be called a new iron curtain, naturally

lead to the formation of a dual currency system.

Bretton Woods-II, which has existed since the 1970s. system is replaced by Bretton Woods III. In its framework, the existing system based on the currencies of the Western world coexists, which is determined by the dollar, and whose credibility is primarily given by financial instruments, and on the other side, the system based primarily on Chinese and Russian currencies is being developed, the basis of which is the existing commodity base, primarily provided by the raw materials.

In his study, Perry Mehrling starts from the concept of "the four prices of money", which he expands on later. According to Pozsár, in every major crisis since 1997, one of the four prices of money came into play, and accordingly, every major crisis was also a monetary crisis. In Perry Mehrling's framework, Parity, Interest, Currency and Price Level were the four prices of money.

In the crisis of 2008, the parity was broken, in March 2020 we had to intervene because of the interest rate, the currency caused problems in several countries of Southeast Asia in 1997. According to Pozsár, the price level has been secondary during the past 25 years, there have been no major crises related to the price level. Rather, the problem was persistently low inflation, which central banks tried very hard to counter with aggressive equilibrium policy (QE), with limited success.

He also points out that

central banks have an easy time when it comes to controlling money prices in the nominal domain, but not when it comes to controlling prices in the real commodity domain.

Especially when the pressure comes not from demand but from supply or rather a supply shock caused by a collapse in demand for certain commodities. For example, in the demand for Russian goods, when the market behaves in the spirit of fear of future sanctions. Central banks are good at curbing demand, but not at creating supply.

Everything requires energy and raw materials, and Russia exports everything, and now, unlike in 1973, not only the price of oil, but the price of everything else has gone up. Now the fourth price of money is emerging, after being dormant for decades, it has now returned in full force. But the price level will soon become very volatile and the market will try to price in the price of future money, i.e. the number of rate hikes and the adjustment of the level of terminal interest rates in response to the new price level regime brought about by war and sanctions.

Pozsár because we move from the nominal domain to the real domain and things get more complicated, so he expanded the framework of the four prices to include foreign goods, shipping and defense.

The new items are all genuine. The infrastructure on which goods are moved. The area of institutions that trade in goods is: commodity traders, banks that finance commodity traders, as well as offices supporting foreign trade, as well as the military faculties of the state, which provide legal and military protection to assets, mines, fields, pipelines, ships, shipping routes, etc.

Like anything else, the price of goods is determined by supply and demand, and supply and demand are always financed by the banks. For price stability, we need structural stability in both nominal and real terms - deflation (structural) occurs when demand cannot be financed, and in contrast, inflation (structural) occurs when supply is disrupted by war and other events.

Such is shipping, when a lot of time and a significant amount of energy is spent on the fact that the Russian raw material is forced to travel more due to the sanctions.

It doesn't matter whether Russian oil reaches Northern European ports in a week, or whether it takes 120 days to travel to China.

However, this way China will buy less oil from the Middle East, and the oil from there will have to travel longer to Europe. This not only means a loss of time, but also requires a lot more ships (ship shortage), i.e. the costs naturally increase.

But it's not just oil costs that are rising. It is enough to think that

this will increase the traffic of the Suez Canal, so the Egyptian government will legally increase the tolls,

to be able to buy more wheat, which will increase the price of all goods passing through the channels, including grain.

With this, commodity exchange traders will need more financing, and banks' own liquidity needs will also increase over time. If not immediately, but inevitably. Pozsár notes that all this will affect the financing markets, commodity market inflation and volatility will drive up credit demand in the commodity market world, and the willingness and ability of banks to meet the credit needs of the commodity market world will decrease.

Banks currently have a lot of excess reserves, so they will be able to lend more to commodity traders in order to move more expensive and more volatile cargo, but the financing stress will spill over, which cannot have a good effect on banks' demand for government securities either.

And in the meantime, the budgets of Western governments should be tightened, since they spent quite a bit during the epidemic. Those who prefer to create sanctions that seek to maximize pain for Russia while failing to minimize financial and price stability risks for the West.

According to Pozsár, the price level is supported by a healthy, well-functioning banking system (demand needs credit; if there is no credit, there is no demand, and prices fall), in addition, a healthy, well-functioning world with efficient and open sea routes (demand you need goods, and if there are no goods, prices will rise quickly).

If the banking system is clogged, credit becomes more expensive, which suppresses demand, and if the commodity trading system is clogged, goods become more expensive, which also suppresses demand.

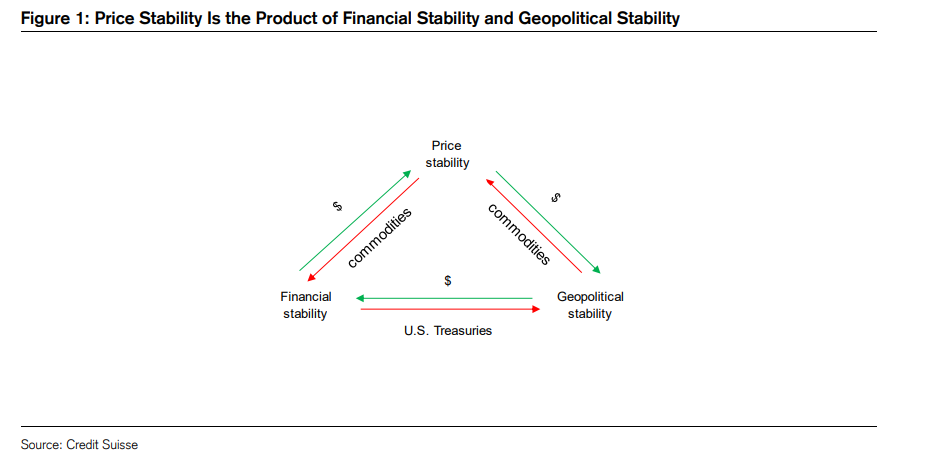

Pozár represents the Bretton Woods II system with a triangle,

where between the left and top vertices is trade and time, and between the right and top vertices is trade and time, where trade and time refer to foreign exchange trading and credit, and goods and transport . And between the bottom two peaks is the monetary arrangement of the unipolar world: Bretton Woods II, where banks create Eurodollars, and OPEC and China buy US government securities with Eurodollars.

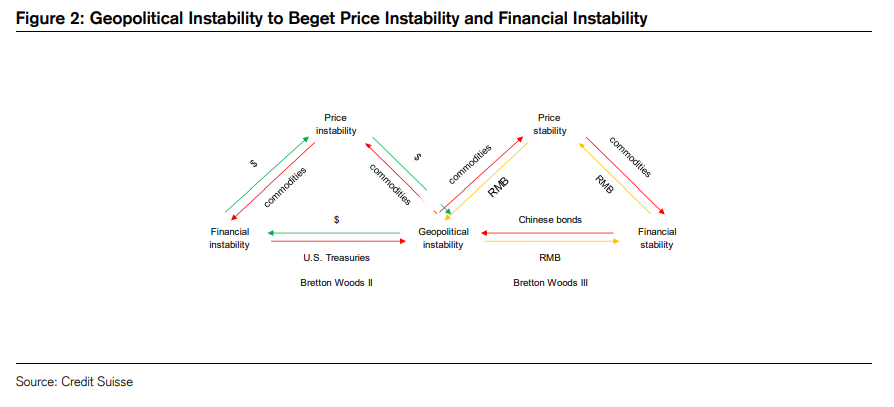

But according to Pozsár, this is not the end of history, instead of one triangle there are now two.

This is natural, since a multipolar (duopolar) world needs two triangles to function, or rather to coexist.

The triangle on the left is the same as the previous one, and the one on the right is conceptually the same as the one on the left, but is anchored with a different currency – Euroreminbi instead of Euro-Dollar. He depicted the two triangles as mirror images of each other, so they have a common geopolitical peak. Because the second triangle grew out of the first due to a geopolitical conflict.

The upper vertex of the second triangle is also connected to the other two vertices by the concepts of trade and time: the left and upper vertex are the concepts of commodity trade and time, and the right and upper vertex are the concepts of currency trade and lending. But here the renminbi is replaced by other currencies instead of the US dollar, and between the bottom two nodes is the monetary arrangement of the new world order: Bretton Woods III, where banks create eurorenminbi and where they accumulate eurorenminbi balances to buy Chinese government securities (not immediately but inevitably), external money like gold instead of G7 internal money, and commodity reserves instead of foreign exchange reserves.

According to Pozár

commodity reserves will be an essential part of Bretton Woods III, and wars have historically been won by those with more food and energy reserves.

The US Department of Agriculture estimates that China has half of the world's wheat reserves and 70% of its corn reserves. In contrast, the USA controls only 6% and 12% of the world's wheat and corn reserves, respectively.

All this affects the price level of food, oil and energy.

But the side-by-side existence of the two triangles has a huge impact on the evolution of inflation in both the East and the West.

According to Pozár, Bretton Woods II. served with deflationary impulses (globalization, open trade, just-in-time supply chains, only one supply chain), Bretton Woods III. and it will provide inflationary impulses (de-globalization, autarky, just-in-case hoarding of goods and duplication of supply chains, and more military spending to protect what maritime trade is left).

Empires rise and fall. Currencies fall and rise. Wars have winners and losers.

Until now, when inflation had to be broken, the unipolar world order and the rise of the euro-dollar helped Western currencies. Shortly after assuming the Treasury post, Connally famously told European finance ministers worried about America's export of inflation that "the dollar is our money, but your problem." Bretton Woods III. your new password is a

"our goods, your problems".