Államadósság Kezelő Központ Zrt. expands its product range with a new 3-year fixed-interest government bond, called Fixed Hungarian State Bond (FixMÁP), and announces to the public a new structure and term, Bonus Hungarian State Bond (BMÁP). The two new types of government securities will be available for purchase from January 8, 2024.

According to the announcement, the State Government Management Center (ÁKK Zrt.) has set the goal of transforming the product structure of retail government securities. As part of this, it introduces the Fixed Hungarian State Paper to the market.

The main advantage of this is the predictability during the entire term, which is ensured by the fixed interest paid with a predetermined, quarterly interest payment frequency.

The first FixMÁP series, called 2027/Q1, will be available with a 3-year term, a fixed annual interest rate of 7 percent, and a HUF 1 base denomination. Its sales period is 3 months, a new FixMAP series is announced every new quarter.

What does the new BMÁP know?

With the new, 5-year BMÁP series 2029/N, the interest rate is still the sum of the interest base and the interest premium, providing an interest premium above the interest base tied to the 3-month Discount Treasury Bill.

It will be 1.5 percent per annum in the first three years, and 2.5 percent per annum in the last 2 years, thereby encouraging and rewarding investors who hold the BMÁP until maturity

- detailed the MTI.

The initial annual interest rate is 8.01 percent.

This is the main change in the new BMÁP, that the new series provides an interest premium of 1, 5 and then 2.5 percentage points above the interest base (the previous series 2025/N and 2026/o give a premium of 1 percentage point, while the 2027/ N 1.5 percentage points).

The 3-year 2027/N series BMÁP can still be purchased under unchanged conditions.

A sales limit is being introduced for both products, it is HUF 50 million for the 2027/Q1 series FixMÁP, and HUF 100 million for the 2029/N series BMÁP, the maximum amount a distributor can sell to a retail investor.

The purpose of the sales limit is to continue to provide a broad service to government bond investors with smaller savings

- indicated the ÁKK.

Fixed Hungarian State Securities can also be purchased by private individuals in the branch network of the Hungarian State Treasury and some banks/investment companies, as well as on the WebKincstár, MobilKincstár and online interfaces of banks/investment companies.

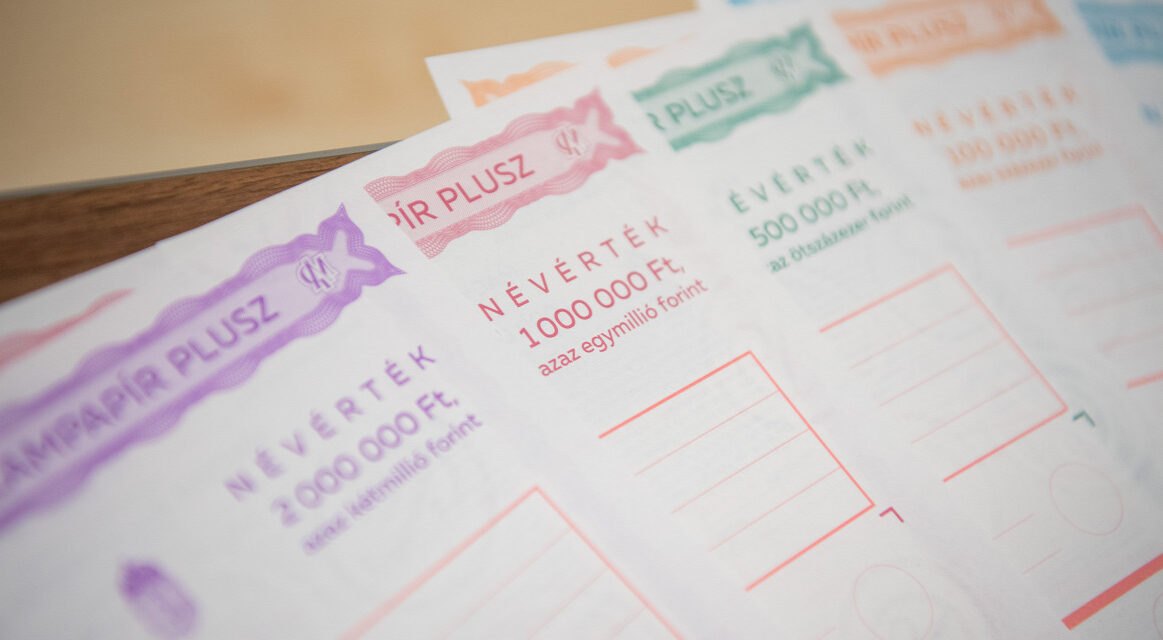

Featured image: Illustration / MTI / Zoltán Balogh