Government Commissioner Alexandra Szentkirályi helps those families raising children who do not yet know how to apply, or whether they should apply separately at all for the tax refund announced by the government. He also added a text guide to his video.

"Next February, all working parents with children will receive back the SZJA paid this year up to the tax level of the average salary.

The tax refund is automatic, but those whose data are not fully available to NAV must now declare.

For example, someone who is entitled to family allowance, but does not receive it , and therefore the NAV does not have the postal transfer address or domestic payment account number required for the allocation. A pregnant woman entitled after a fetus or her spouse living in the same household as her. NAV does not know their data necessary for allocation.

A person who receives a disability pension and during the year he or his relative living in the same household applies the family discount. NAV does not know their data necessary for allocation.

He is an individual registered as a small taxpayer and does not receive family allowance. NAV does not know their data necessary for allocation.

You request the allocation of the tax refund to a different location than where you receive the family allowance.”

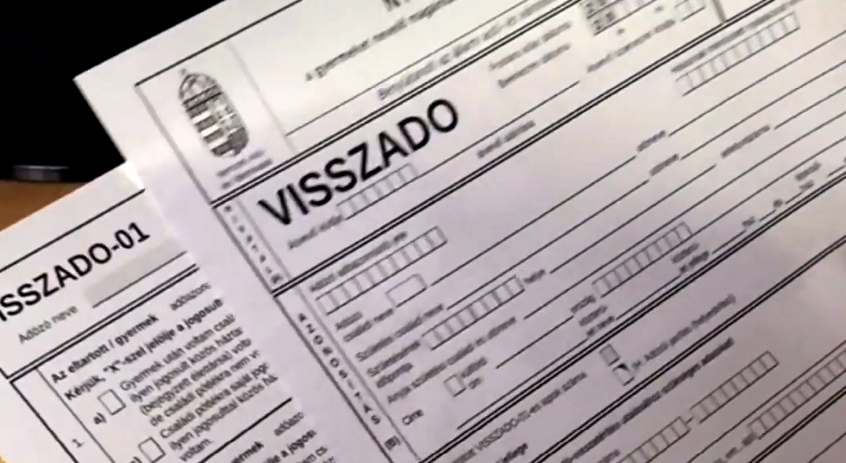

In order to make it easier to apply for a tax refund , the government commissioner showed in a video how and who should submit the "Refund" application form.

(Header image: Facebook/Szentkirályi Alexandra)