Life did not confirm the concerns of the Budapest city administration regarding the halving of the business tax, reports Világgazdaság. They added: the payments planned for this year have not decreased, but the budget will not survive the re-planning.

Mandiner reviewed the article, in which it can be read, among other things, that despite the automatic halving of the business tax for micro, small and medium enterprises (SMEs), the capital will be able to maintain the 139 billion business tax revenue planned for this year - this was discussed by Ambrus Kiss in a press conference. background conversation.

In December last year, the government announced that it would cut business tax for SMEs and sole proprietors in half from January 1 of this year.

The decision was strongly criticized by the Budapest city administration from the beginning , which is why the current statement of the general deputy mayor can be interpreted as a turning point. For example, Ambrus Kiss stated earlier that the capital's money could run out by November if the government really halves the business tax, and Mayor Gergely Karácsony called the plan an execution of self-government.

However, the fears were not justified, they write: although the discount alone represents a hole of 17 billion – roughly equivalent to one month's expenses of the capital city – in the budget of the capital city government, it was able to be patched up by the increasing payments from multinational companies. This scenario is certainly fortunate for the town hall, but it cannot be said that it could not have been foreseen, writes Világgazdaság. Kiss Ambrus on the fact that most of the business tax revenues come from a few large companies whose activities were not affected by the pandemic. He added that, in addition, the rise in inflation also results in a surplus during the business tax. I see the amount of HUF 139 billion as safe, the real income was able to cover the missing HUF 17 billion, he stated.

the full article here .

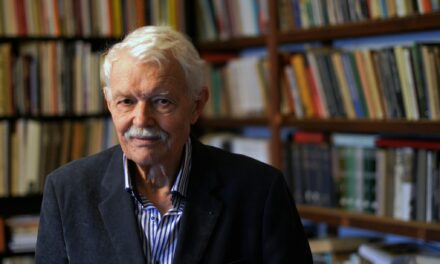

Photo: Csaba Jászai