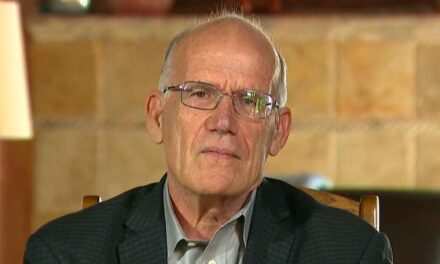

The maniacal pursuit of diversity and fairness, i.e. "woke-ism", is responsible for the collapse of the American Silicon Valley Bank, writes Douglas Murray, a British writer living in America, on the New York Post website.

In the writing seen by Neokohn, Murray states that this week America received another reminder that they are far too tolerant of this crazy, anti-excellence agenda.

"Because even though the bridges haven't collapsed yet, the banks have. And one of the reasons for this is that the banks in question prioritized fairness over excellence”

Murray writes.

According to the author, the maniacal pursuit of diversity led to masses of incompetent people being placed in leading positions, and female representation became particularly maniacal.

"Obsession with women's representation is of course only a problem for high-status jobs. Board seats, Hollywood star salaries and more. To my knowledge, there is no movement advocating for equal representation of women among American road builders," writes the bestselling author.

If Lehmann Brothers had been Lehmann Sisters, Christine Lagarde used to say, then perhaps the global financial crisis would not have occurred". However, according to Murray, Jay Ersapah's story does not show that.

“Jay is a woman and held the risk management position at SVB. But if Jay spent time trying to manage the risks, I don't know how he did it because his full-time job seemed to be promoting crazy nonsense within SVB."

Murray writes.

For example, The Post found, Ersapah spearheaded initiatives such as the month-long Pride campaign, a blog highlighting mental health awareness among LGBTQ+ youth, and co-chaired SVB's European LGBTQIA+ Employee Resource Group.

At such events, Ersapah spoke about what it feels like to be "a queer person of color and a first-generation immigrant from a working-class background."

“By today's standards, Ersapah is an absolute jackpot. The winner of the intersectional grievance pyramid is if one is looking for the most oppressed person. Today's ethics dictate that such a person not only has a right to any position, but his mere presence brings immeasurable (and unspecified) benefits to the company.

What a pity that the only thing that Ersapah cannot be identified as is "knowledgeable"

Douglas Murray writes sharply.

“If he had been competent, he might have done a better job of what would have been his main job, which was risk management. For which he and the bank as a whole were clearly unfit. "

Murray describes how only one board member of the failed bank's board had a career in investment banking.

The rest of the board were donors to the Clintons and other top Democrats. One of them was even an improvisational performer.

Murray notes that the last time the world economy nearly collapsed was in part because banks gave loans to people based on, among other things, race.

“But a responsible bank cannot give credit solely because of someone's race, gender or sexuality. They should simply and exclusively look at whether or not the person can repay the loan - whether it's a mortgage or a business. If we prioritize anything else, we are not 'managing risk'. But we create it. SVP and other banks have done this with their crazy emphasis on woke investment policy,” Murray declares.

"So yes, the bridges are still standing for now. But the banks are not," concludes the author, who believes that America should quickly rethink what it is doing before the economy collapses on its head.

The full article HERE .

Photo: Pixabay